Pay stubs and checks can be exported to PDF and then emailed.Įasy payroll tax reporting, compliance, record keeping and data export / import capabilities. Handles Cafeteria Plans (Section 125), SIMPLE IRA, SEP, and others). (Requires Payroll Mate Option #2 - Additional Fee) Also includes a generic payroll export capability for any accounting software that can import general ledger information.Ĭreates NACHA files for doing direct deposit. Includes special export capability for QuickBooks, Quicken, Sage 50 and Peachtree.

Start at any time during the year and import employee information / payroll setup. You can add Payroll Mate Option #3 (for $100 more) if you want to process payroll for 100 or less companies (up to 1,000 employees / company). If you process payroll for 10 or less companies (up to 75 employees / company) then you only need Payroll Mate for $219. Works for any type of business, tax practitioners, not-for-profits, banks and local governments.ĭesigned for any size business, from 1 to 1000 employees.

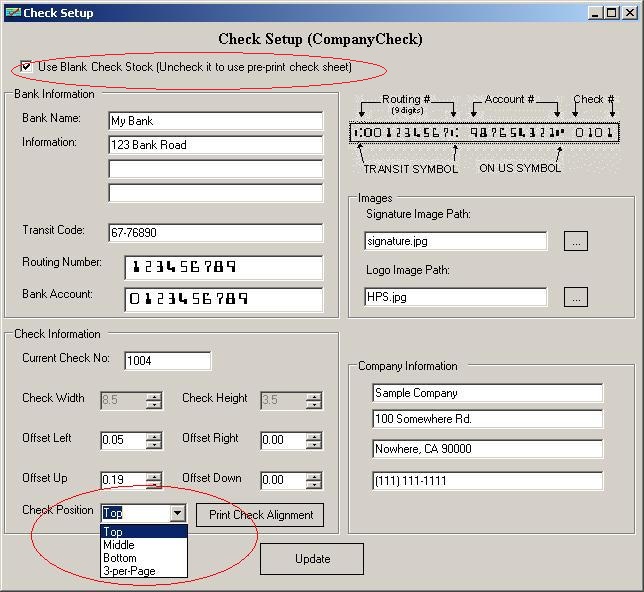

Supports payrolls over 10 million dollars, which is a limitation in other payroll software Pay truck drivers with per-mile pay and farm workers with per-piece pay. Prints MICR encoded checks for printing on blank check stock (Requires Payroll Mate Option #4 - Additional Fee)

Runs on Windows XP/ 2003 / Vista / 7 / 8 / 8.1. Supports weekly, bi-weekly, semi-monthly and monthly pay periods. Supports salary, regular pay, overtime, double time and shift differentials.īackup and restore capability to local disk, flash drive and more. The software is not limited by the built-in payroll items. Highly customizable by providing the ability to define any type of pay, tax or deduction.

Supports federal and state unemployment / disability taxes.Ĭalculates Social Security and Medicare Taxes.Ĭustom define any number of local taxes without limitations. Pre-loaded tax tables for federal and state withholding. Run payroll in-house and print payroll checks on your computer.

0 kommentar(er)

0 kommentar(er)